My Weblog entry for today found something surprising: the correlation between the surveyed bullishness of investors (Investors Intelligence survey) and their actual ratio of mutual fund purchases to redemptions has been slightly negative. In other words, what investors say about the market has had no positive relationship to what they're actually doing--at least with respect to mutual funds.

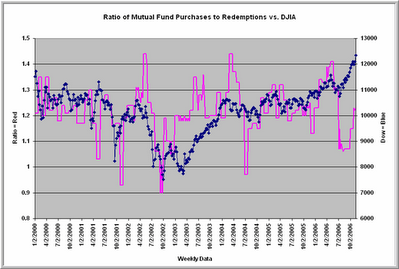

Above, we can see the ratio of fund purchases to redemptions from 2000 to the present, charted against the Dow Jones Industrial Average (N = 334 weeks). Note how the ratio was consistently elevated above 1.0 during the 2000 market top and dropped below 1.0 during the subsequent decline. Notice also that we rose well above 1.0 in May of this year at the market top and dipped close to 1.0 at the market bottom in July prior to the recent rally. So far, we haven't seen a meaningful bounce in the ratio as the market has ridden its wall of worry higher.

Since 2000, dips in the ratio of mutual fund purchases to redemptions have provided solid buying opportunities. When the ratio has exceeded 1.20 (N = 198), the next 20 weeks in the Dow have averaged a loss of 1.29% (92 up, 106 down). When the ratio has been below 1.20 (N = 136), the following 20 weeks in the Dow have averaged a gain of 3.36% (93 up, 42 down). It appears that investors attempt to time their mutual fund purchases and redemptions and have been quite poor in their timing.

While we see very bullish sentiment in the recent surveys, the ratio of mutual fund purchases to redemptions has only recently popped up to 1.25. Should we see higher ratios ahead--approaching the 1.4 level from May and from early 2004--I'll take that as a yellow sentiment light for this market. As noted in the Weblog, throughout the recent bull market we have seen nothing like the 2-plus to 1 ratios from the 1990s; since the 2000-2003 decline, investors, as a whole, have been modest in their mutual fund purchase patterns.

In other words, today's investors may talk a good bullish game, but they really haven't put their money where their surveys have been.