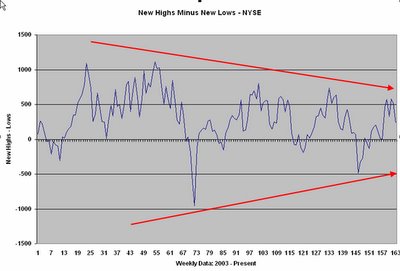

Here you can see weekly new highs minus weekly new lows for the NYSE, 2003 - present. The pattern is quite clear: we're seeing fewer stocks participate during market rallies, but we're also seeing modest levels of new lows. In all, this is consistent with low volatility market conditions, and it is also consistent with past bull market patterns.

Here you can see weekly new highs minus weekly new lows for the NYSE, 2003 - present. The pattern is quite clear: we're seeing fewer stocks participate during market rallies, but we're also seeing modest levels of new lows. In all, this is consistent with low volatility market conditions, and it is also consistent with past bull market patterns.In general, we see several phases to a market cycle. The earliest phase of the bull is one of great momentum, with a majority of issues participating and making new highs. As the bull matures, we continue to see price highs for most indices, but a declining number of individual issues making new highs. Late in the bull market, new lows will expand, new highs will dwindle, and the indices will fail to make new price highs on rallies. This sets up a phase of bear market selling, with new lows consistently exceeding new highs--interrupted by brief short-covering rallies--followed by a washout period of capitulation in which new lows vastly outnumber new highs.

Using this broad schematic, we can see that we're still in the phase of the bull where we have made new price highs but with decreased participation from individual stocks. It is normal to experience a pullback following such rallies; these bear swings are generally prefaced by an expansion in the number of stocks making new lows. As long as we do not see a more negative new high/low balance than was recorded at the October lows, I will not worry overmuch about the bull market. A signficant expansion of new lows would, IMHO, be of greater concern.

The aging of the bull is generally also heralded by shifts in market leadership. We saw this during the market peak around 2000-2001. Speculative favorites give way to more defensive stocks as economic concerns come to the fore. The current collapse of such favorites as GOOG and YHOO, as well as the gold and oil stocks, is on my radar for that reason.

In short, it looks to me as though we're in a mature bull market, but not one that is yet showing signs of imminent collapse. This doesn't affect my day-to-day trading outlook greatly, but is relevant to longer-term trading and investing horizons. I am very open to the possibility that the early January highs were the price highs for this bull market, but will not stay fixed in that view if the ES can sustain a low in the mid 1250s.