9:58 AM - OK, you can see how the rally stalled once the buying activity could no longer push prices higher. In general, once you identify a candidate morning low, it makes sense to put in an initial position and use pullbacks in the TICK as opportunities to add to the position, as long as the TICK bursts take you to successive price highs. If you can't hit your price target and the buying sentiment (TICK, volume at offer) isn't moving you higher, then you have to entertain the hypothesis that you're in a trading range environment and take what you can from the market. In general, I've been front-running the market with my initial positions and need to work on that initial entry timing. The smart strategy is to wait for the selling to hold above a prior price low and then begin the buying. I'll be reviewing the last few days to sharpen that strategy. Volume is tailing off here, suggesting continued range bound action. I'll update tonite on the Weblog; have a great remainder of your day!

9:43 AM - My apologies; I've been fielding phone calls all AM from trading firms, trying to trade, and trying to update the blog. I can't recommend that as a way to trade! Anyhow, I had modest profits in the position and was noticing that, despite the good action in DAX, the bounces in the TICK were not moving my market higher. That turned out to be a good short-term decision. As long as the TICK declines were at higher price levels and the bounces were at higher levels, it made sense to hang in there for my price target. But when we got the TICK bounces at 9:35 and 9:40 and couldn't make new highs, I decided to take what the market was giving me. Admittedly some of the decision was that, right now, I'm completely distracted and not in a good mind set to be holding any position of size.

9:41 AM - Took my money and ran.

9:19 AM - Note the nice breakout to the upside in DAX. Semis lagging.

9:17 AM - The TICK pullback, holding above the AM lows, gave a nice entry; now we have to stay above that level in any selling. My target is the preopening high in ES, then S1, then Monday's high.

9:07 AM - If we can hold above the AM lows in ER2 on selling bouts in TICK, I'd add to my long. With a small position, as long as we hold above the previous day's low on selling, I'm willing to hold. But I'm not going to put on size until the buying is clearly manifest and selling dries up above the AM lows.

8:56 AM - Just got off phone with DJ News. Clearly it's premature to be long, given ER2 selling. Prices moved right back into value area and below in ER2.

8:45 AM - ER2 showing relative weakness; need to see some buying interest there; DAX holding up; volume moderate, with usual local-driven crosscurrents, but no distinct buying or selling.

8:35 AM - Long a bit ES here.

8:32 AM - Watching NQ and ER2 closely. If they take out their preopening lows, I'm much less likely to be aggressive with any longs in ES.

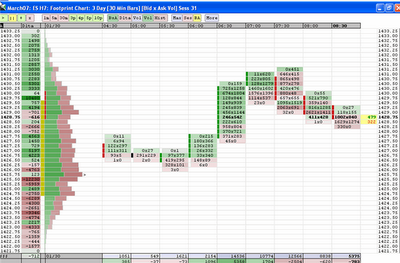

8:19 AM - Here's what my Market Delta screen looks like this AM. Note how we couldn't sustain volume to the upside and pulled back into the region where most of trading was recently transacted (left Y axis). That chunky volume region will act as a magnet for prices that try to break out; we'll need good volume and participation to sustain such a break.

8:06 AM CT - Good morning! I don't expect a lot of fireworks today, as we await the Fed announcement tomorrow. Jason Goepfert, who does excellent work with his SentimenTrader service, notes that we tend to have narrow range days prior to such Fed announcements. We have consumer confidence numbers coming out at 9:00 AM CT, and that's pretty much it for economic releases on the day. I have a mild bullish leaning for the day; check out my most recent post. It's a nice illustration of the kind of research I do each evening and AM prior to the open to try to identify the odds of a rise or decline during the day's trade. As always, pivot levels for the day are listed on the Weblog. As I write, we're trading slightly above the Monday VWAP, reflecting a boost in the DAX (and Euro) prior to the open. We've since come off the pre-open high of 1431.25, so that will be a natural level to keep an eye on. If we get buying that peters out before taking out that pre-opening high, I'd look to sell for a move back to the Monday pivot/VWAP. If we get selling that holds above the Monday low--and especially above the pivot/VWAP--I'd be looking to take out that preopening high. At this juncture, I look for us to test the highs from the previous two trading sessions, but will need to see the usual evidence of buying interest in the TICK and volume at bid vs. offer to take that trade. Back after the open!