My recent post emphasized how important it is to follow the global markets and track their impacts upon stocks. Here we'll look at corporate bonds--the Dow Jones 20 Bond Index--and their relationship to stock prices (S&P 500 Index).

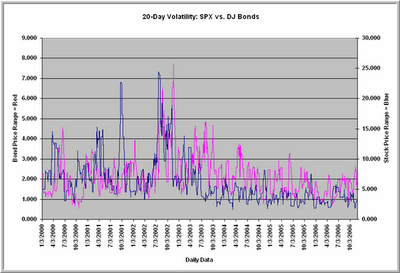

The chart above shows an interesting relationship. Since 2000, the 20-day volatility--as measured by high-low percentage range--of corporate bonds and stocks correlate by about .25. Note how volatility has come out of both markets since the 2002 volatility peak. Corporate bond volatility bottomed out in May of this year and has been on the rise since then; that is not true of SPX volatility. One hypothesis I'm entertaining is that increasing volatility in interest rates and the dollar will be leading increasing equity volatility.

Since 2004 (N = 715 trading days), when the Dow Jones 20 Bonds have been up over the last 20 days, the next 20 days in SPX have been up by an average of .88% (311 up, 135 down). When the Dow Bonds have been down over a 20 day period, the next 20 days in SPX have been up by an average of only .15% (151 up, 118 down). Strong corporate bonds have thus tended to lead strong stocks and weak bonds (i.e. rising rates) have led to subnormal performance. Indeed, when the bonds have been down more than 2% over a 20-day period (N = 44), the next 20 days in SPX are down by an average of -.35% (16 up, 28 down).

Whatever you trade--individual stocks or equity indices--does not exist in isolation. Interest rates affect business profitability, and fixed rate instruments compete with stocks for capital. Short-term traders focusing solely on short-term patterns in their own instrument run the risk of picking up nickels in front of a global macro steamroller.