Here are a few topics and resources on this post-election morning:

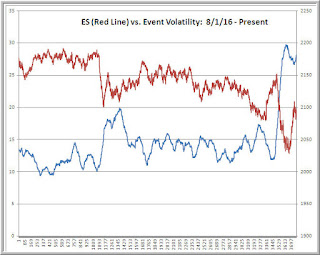

* I think it's fair to say that most people--myself included--did not expect the election outcome. One result of the surprise is that realized volatility has gone through the roof during overnight trade in the ES futures. I use a measure of "event volatility", which is the price movement of bars that are based upon either volume or price movement. This is a "pure" measure of volatility, which tells us the volatility per unit of volume or price change. Note in the chart above that we've spiked on the event volatility measure. We're now at levels last seen at the January/February and Brexit lows. In general, high event volatility has been associated with intermediate-term market bottoms, not tops.

* The resulting huge rise in realized volatility means that not only are we seeing above average volume, but each unit of volume is moving the market twice as much as just a few days ago. That's a double barreled effect, and it's extremely relevant for sizing positions. Easy to underestimate the amount of risk you're actually taking.

* Here is a link to a recording of the webinar I gave for the SMB Options Tribe re: best trading practices of successful traders. I've been impressed by the work of the Tribe...they emphasize ways of trading options that don't involve being glued to screens daily.

* Here is a link to a recording and podcast of the webinar I gave for the LockeInYourSuccess group re: the best psychological practices of successful traders. John Locke has developed a number of options trading models that might be of interest to traders. He recently announced an interesting affirmation challenge for traders.

* The best way to use these webinar recordings is to pick out one idea from each that is worth working on as a goal, so that you're not just listening passively to a presentation, but actively learning and moving yourself forward.

Further Reading: Volume and Volatility and What They Mean for Trading

.

* I think it's fair to say that most people--myself included--did not expect the election outcome. One result of the surprise is that realized volatility has gone through the roof during overnight trade in the ES futures. I use a measure of "event volatility", which is the price movement of bars that are based upon either volume or price movement. This is a "pure" measure of volatility, which tells us the volatility per unit of volume or price change. Note in the chart above that we've spiked on the event volatility measure. We're now at levels last seen at the January/February and Brexit lows. In general, high event volatility has been associated with intermediate-term market bottoms, not tops.

* The resulting huge rise in realized volatility means that not only are we seeing above average volume, but each unit of volume is moving the market twice as much as just a few days ago. That's a double barreled effect, and it's extremely relevant for sizing positions. Easy to underestimate the amount of risk you're actually taking.

* Here is a link to a recording of the webinar I gave for the SMB Options Tribe re: best trading practices of successful traders. I've been impressed by the work of the Tribe...they emphasize ways of trading options that don't involve being glued to screens daily.

* Here is a link to a recording and podcast of the webinar I gave for the LockeInYourSuccess group re: the best psychological practices of successful traders. John Locke has developed a number of options trading models that might be of interest to traders. He recently announced an interesting affirmation challenge for traders.

* The best way to use these webinar recordings is to pick out one idea from each that is worth working on as a goal, so that you're not just listening passively to a presentation, but actively learning and moving yourself forward.

Further Reading: Volume and Volatility and What They Mean for Trading

.