Friday, February 5th

* Despite a morning selloff after early strength, stocks finished the day on the firm side. 432 stocks across all exchanges touched monthly highs versus 293 monthly lows. Over 50% of SPX shares are trading above their 3, 5, 10, and 20-day moving averages. I am watching closely to see if breadth can expand in today's trade. The response to the non-farm payrolls number will have a lot to do with that.

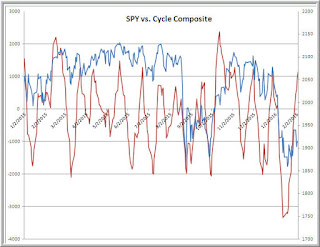

* Interestingly, my cycle measures are near levels that have corresponded to market tops. Should we be unable to surmount the highs reached on February 1st, that would invite the hypothesis that we've put in an intermediate-term top and are likely to retest recent lows.

* Working off the oversold cycle readings with a relatively modest bounce from the lows is once again an indication that the 2016 market is different from those experienced in 2014 and 2015. The weaker US dollar has added an interesting element to stock prices. Note the recent strength of raw materials share (XLB). The bounce in housing shares (XHB) has not been impressive.

Wednesday, February 3rd

* Tuesday's trade in ES nicely illustrated the dynamics of a downside trend day, including an opening price near the high price for the day session; negative NYSE TICK dominating positive readings, with many readings < -800; a very negative advance/decline line; and a great majority of NYSE stocks trading below their VWAPs for the day. Trend days often feature above average volume, as directional, macro participants express an intermarket theme. In yesterday's case, we saw the resumption of the risk-off trade involving oil, stocks, high yield credit, and emerging markets. I am watching those intermarket relationships carefully from day to day.

* A useful short-term overbought/oversold measure is a five-day moving average of upticking vs. downticking among NYSE stocks. Note how we reached a short-term peak recently.

Tuesday, February 2nd

* After early weakness, we continued to move higher on Monday, hitting a new high for the recent rally off the lows. Across all exchanges, we had 502 shares register fresh monthly new highs against 251 new lows. That is a modest expansion from Friday's levels. Oil continues to come well off its recent highs and we've seen selling in stocks in premarket trading. Interestingly, stocks are lower in Japan following the BOJ action and we're down in Europe as well. At least so far, the rally off the lows still strikes me as part of a bottoming process, not a fresh bull market leg.

* Here's a look at one of my primary cycle measures. My base case that this cycle will top out at a lower price high and lead to a test of the recent market lows. Should we see waning breadth on the upside on future strength, that would add credence to this view. As of Monday's close, we were short-term overbought, with over 80% of SPX shares closing above their 3, 5, and 10-day moving averages. (Data from Index Indicators; it's a great site for breadth info).

* A look at sectors from the excellent FinViz site finds that yield-sensitive utility and consumer staples shares have led market performance year-to-date. Interestingly, financial shares are among the largest losers during 2016 thus far. Given concerns over debt--China and high yield--this is not a bullish configuration of sector strength. It's clearly defensive.

Monday, February 1st

* Here's a valuable self-coaching technique to help prevent impulsive decision making in the heat of trading.

* I was less than enamored with the bounce we had made off the lows when I wrote Friday's entry, but flows changed radically with the New York open, as we saw consistent strong buying in the wake of the BOJ's negative rate decision. After a strong opening rise, we saw significant selling pressure late in the morning, which completely failed to take the market significantly lower. From there buyers remained in control, as we completed a trend day. One of the important takeaways from the session is the importance of viewing each major time period (Asia; Europe; US) as a distinct "day", with its own set of market participants. When we see discontinuity from one time period to another, that is important information and requires quick adjustment.

* Breadth expanded significantly with Friday's strong rise. Across all exchanges, we saw 436 fresh monthly highs against 296 lows. It was the first time since December 30th that monthly highs have outnumbered lows. Similarly, Friday saw over 80% of SPX stocks close above their 3 and 5-day moving averages and almost 80% above their 10-day averages. This was not only a strong rally, but a broad one. If, indeed, the BOJ decision was a game-changer for stocks, we should not revisit the post BOJ lows from Friday. A return to that 1880 area would be an important reversal from a longer-term perspective, and one that would be consistent with the topping view outlined last week.

* We've pulled back in overnight trade, with a sharp decline in oil. I am watching carefully to see if that correlation between stocks and oil reasserts itself. I'm also watching closely to see if we can stay above that 1880 level in the ES futures outlined above.

* Despite a morning selloff after early strength, stocks finished the day on the firm side. 432 stocks across all exchanges touched monthly highs versus 293 monthly lows. Over 50% of SPX shares are trading above their 3, 5, 10, and 20-day moving averages. I am watching closely to see if breadth can expand in today's trade. The response to the non-farm payrolls number will have a lot to do with that.

* Interestingly, my cycle measures are near levels that have corresponded to market tops. Should we be unable to surmount the highs reached on February 1st, that would invite the hypothesis that we've put in an intermediate-term top and are likely to retest recent lows.

* Working off the oversold cycle readings with a relatively modest bounce from the lows is once again an indication that the 2016 market is different from those experienced in 2014 and 2015. The weaker US dollar has added an interesting element to stock prices. Note the recent strength of raw materials share (XLB). The bounce in housing shares (XHB) has not been impressive.

Wednesday, February 3rd

* Tuesday's trade in ES nicely illustrated the dynamics of a downside trend day, including an opening price near the high price for the day session; negative NYSE TICK dominating positive readings, with many readings < -800; a very negative advance/decline line; and a great majority of NYSE stocks trading below their VWAPs for the day. Trend days often feature above average volume, as directional, macro participants express an intermarket theme. In yesterday's case, we saw the resumption of the risk-off trade involving oil, stocks, high yield credit, and emerging markets. I am watching those intermarket relationships carefully from day to day.

* A useful short-term overbought/oversold measure is a five-day moving average of upticking vs. downticking among NYSE stocks. Note how we reached a short-term peak recently.

Tuesday, February 2nd

* After early weakness, we continued to move higher on Monday, hitting a new high for the recent rally off the lows. Across all exchanges, we had 502 shares register fresh monthly new highs against 251 new lows. That is a modest expansion from Friday's levels. Oil continues to come well off its recent highs and we've seen selling in stocks in premarket trading. Interestingly, stocks are lower in Japan following the BOJ action and we're down in Europe as well. At least so far, the rally off the lows still strikes me as part of a bottoming process, not a fresh bull market leg.

* Here's a look at one of my primary cycle measures. My base case that this cycle will top out at a lower price high and lead to a test of the recent market lows. Should we see waning breadth on the upside on future strength, that would add credence to this view. As of Monday's close, we were short-term overbought, with over 80% of SPX shares closing above their 3, 5, and 10-day moving averages. (Data from Index Indicators; it's a great site for breadth info).

* A look at sectors from the excellent FinViz site finds that yield-sensitive utility and consumer staples shares have led market performance year-to-date. Interestingly, financial shares are among the largest losers during 2016 thus far. Given concerns over debt--China and high yield--this is not a bullish configuration of sector strength. It's clearly defensive.

Monday, February 1st

* Here's a valuable self-coaching technique to help prevent impulsive decision making in the heat of trading.

* I was less than enamored with the bounce we had made off the lows when I wrote Friday's entry, but flows changed radically with the New York open, as we saw consistent strong buying in the wake of the BOJ's negative rate decision. After a strong opening rise, we saw significant selling pressure late in the morning, which completely failed to take the market significantly lower. From there buyers remained in control, as we completed a trend day. One of the important takeaways from the session is the importance of viewing each major time period (Asia; Europe; US) as a distinct "day", with its own set of market participants. When we see discontinuity from one time period to another, that is important information and requires quick adjustment.

* Breadth expanded significantly with Friday's strong rise. Across all exchanges, we saw 436 fresh monthly highs against 296 lows. It was the first time since December 30th that monthly highs have outnumbered lows. Similarly, Friday saw over 80% of SPX stocks close above their 3 and 5-day moving averages and almost 80% above their 10-day averages. This was not only a strong rally, but a broad one. If, indeed, the BOJ decision was a game-changer for stocks, we should not revisit the post BOJ lows from Friday. A return to that 1880 area would be an important reversal from a longer-term perspective, and one that would be consistent with the topping view outlined last week.

* We've pulled back in overnight trade, with a sharp decline in oil. I am watching carefully to see if that correlation between stocks and oil reasserts itself. I'm also watching closely to see if we can stay above that 1880 level in the ES futures outlined above.