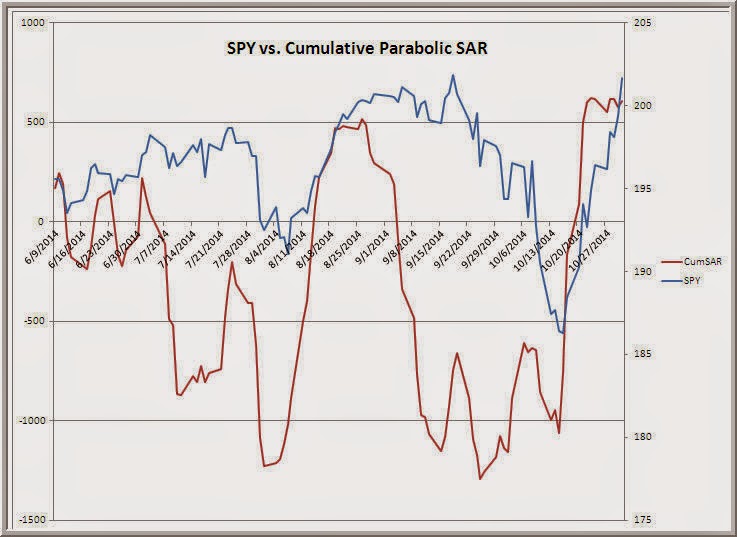

* Above is a chart I constructed that is a running, cumulative total of NYSE stocks giving buy vs. sell signals for Wilder's Parabolic measure (raw data from Stock Charts). You can see that the measure tends to peak and valley ahead of the overall market during intermediate-term cycles. It is but one measure I track that is at or near levels that have corresponded to past momentum peaks. If, however, this recent move higher truly is a fresh bull leg up in the market and not part of a broader topping picture, then we should see this and similar measures stay persistently above the zero line.

* Here is a different perspective on breadth from the very savvy Trader Hacks site. David points out that not all market indexes are displaying strength. I find when people vocally disagree with something I write and offer no evidence whatsoever, it usually makes sense to double down on my positions. When people disagree and offer a variety of evidence, it usually makes sense to revisit my positions.

* Some great links from Abnormal Returns, including a very thoughtful account of how passive investing is impacting the nature of stock market corrections.

* Excellent video from Marcos Lopez de Prado on the dangers of backtest overfitting, selection bias, and other biases that affect quantitative finance. If you conduct enough tests, you're likely to find something "significant". And if you find enough "significant" results, you'll eventually find ones that accord with your views!

* Here is a very clearly laid out argument for raising income tax rates to 80% for the highest earners. Here is a well-constructed counter argument debunking the notion of income inequality. I won't reveal where I stand on the issue, but do note that I find it fascinating that confiscation of 100% of the fruits of a person's productive labor is slavery, but confiscation of 80% constitutes progressivism.

* Fascinating study on how media coverage of stocks increases investor biases. It would be interesting to see if similar effects are seen for stocks that find wide social media coverage.

* Not an easy paper, but a very interesting look at a fresh way to visualize volatility and correlation regimes.

Have a great start to the week!

Brett

.

* Here is a different perspective on breadth from the very savvy Trader Hacks site. David points out that not all market indexes are displaying strength. I find when people vocally disagree with something I write and offer no evidence whatsoever, it usually makes sense to double down on my positions. When people disagree and offer a variety of evidence, it usually makes sense to revisit my positions.

* Some great links from Abnormal Returns, including a very thoughtful account of how passive investing is impacting the nature of stock market corrections.

* Excellent video from Marcos Lopez de Prado on the dangers of backtest overfitting, selection bias, and other biases that affect quantitative finance. If you conduct enough tests, you're likely to find something "significant". And if you find enough "significant" results, you'll eventually find ones that accord with your views!

* Here is a very clearly laid out argument for raising income tax rates to 80% for the highest earners. Here is a well-constructed counter argument debunking the notion of income inequality. I won't reveal where I stand on the issue, but do note that I find it fascinating that confiscation of 100% of the fruits of a person's productive labor is slavery, but confiscation of 80% constitutes progressivism.

* Fascinating study on how media coverage of stocks increases investor biases. It would be interesting to see if similar effects are seen for stocks that find wide social media coverage.

* Not an easy paper, but a very interesting look at a fresh way to visualize volatility and correlation regimes.

Have a great start to the week!

Brett

.