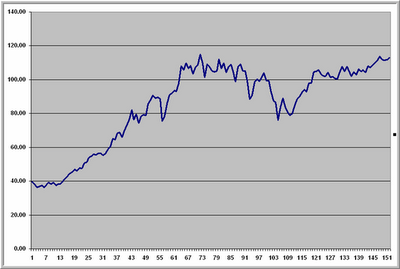

How would you like to own this stock? It pretty much tripled in price, retraced a portion of those gains, and now is knocking at the door of breakout--and alltime--highs.

What's more, there's quite a bit of bearish sentiment on the shares, as the stock has climbed a wall of worry regarding the firm's domestic and overseas operations. It has reported setbacks in its recent Middle East results and is losing money at home. A recent poll compiled by Mark Young showed 26% bulls, 42% bears on the issue. Indeed, traders have been bearish on the stock each week for the past 15 weeks, with this last week a lone exception by only the slightest of margins.

Clearly, someone is seeing value in this firm, even amidst the bearish news and sentiment. What is this resilient issue?

Multiply the stock price by 100 and recognize that each data point is a monthly close, and you have the U.S. equity market: the Dow Jones Industrial Average from 1994 through the present.

After all the bad news we've had, that's what the U.S. stock market looks like.

That's after the bond decline of 1994, after the Asia crisis of 1997, after the Long Term Capital Management bust in 1998, after the dot-com blowup from 2000-2002, after 9/11 and ongoing concerns over terrorism, after record deficits, after a troubled war in Iraq, after devastating hurricanes, after soaring oil prices, after rising interest rates from the Fed, after falling Presidential popularity, and after a weakening housing market.

I'm not sure what kind of bad news will tank this market, but I suspect it's going to have to be worse than the above. And if the news turns better? Perhaps those traders holding up U.S. shares are anticipating just such a possibility.