Friday, March 4th

* We continue to see buying interest in stocks, particularly among smaller and midcap names, but it's the absence of selling pressure that's particularly notable. We have been getting few highly negative NYSE TICK readings and that is creating relatively modest pullbacks. Meanwhile, breadth continues to expand, as the chart of stocks making fresh three-month highs versus lows illustrates:

* I notice both equity and index put/call ratios have come down, if we look across all issues and all exchanges. This by itself doesn't create a sell signal, but it's an early sign of the kind of bullishness that typically leads to a market peak. Volume and volatility also continue to come down, with VIX closing below 17. Note in the chart above how we took out lows from last year, only to now return into the year's range. I would not be surprised to see an eventual test of the highs of that range, given the considerable momentum thrust off the recent lows.

Thursday, March 3rd

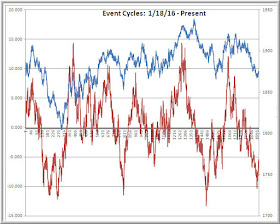

* I've mentioned how viewing markets from a cycle perspective has been exceedingly useful in my own trading. Below is an example of how I'm using short-term cycles built with event bars to identify potential points for entry and exit execution. I find that the markets' cyclical structure becomes clearer when using event bars rather than bars denominated in time. The chart below makes use of volume bars.

* We continue to see buying interest in stocks, with some rotation among sectors and small/midcaps outperforming. The number of stocks across all exchanges making fresh monthly highs expanded once again, from 1310 to 1465; new lows dipped from 146 to 112.

* Market volume and volatility appear to be on the wane as we move higher. That has ramifications for price targets and stops. My measure of pure volatility (volatility per unit of market volume) has been coming off the highs we saw at the market lows. That means that, not only are we getting less volume, each unit of volume is moving the market less. Adapting to such market changes is essential.

Wednesday, March 2nd

* Yesterday was about as textbook as it gets when it comes to upside trend days. We saw very positive breadth early in the session, the broad participation of market sectors, consistently positive NYSE TICK, and a healthy majority of shares trading above their day's VWAPs throughout the trading session. Identifying such days relatively early in the session can yield very profitable day trades. Pullbacks in NYSE TICK at successively higher price lows offer good entry points.

* The fact that we got an upside trend day and made fresh rally highs off yesterday's short-term oversold readings attests to the vigor of the present rally. Breadth once again expanded, with 1310 stocks making fresh monthly highs against 146 lows. VIX collapsed to below 18, a new low for this move. This is a market getting stronger; we're not yet seeing evidence of upside breadth divergences typical during topping processes. Note, however, that we're once again stretched in short-term breadth, with over 80% of SPX stocks trading above their 3, 5, 10, and 20-day moving averages.

* The chart below of new highs versus new lows for SPX stocks (raw data from Index Indicators) shows how we continue to make fresh highs on strong breadth readings. That is typical of the momentum phase of a market cycle. The cycle concept is important, because it orients us as to when to expect momentum and when to expect mean reversion. It is a massive mistake to assume that a market is "due for a correction" simply because we've had a large price move. It all depends upon where we stand across market cycles.

Tuesday, March 1st

* I believe this is one of the most important posts I've written and helps explain how a great deal of the frustration traders experience comes from logical sources, not psychological ones. This approach opens the door to an entirely different way of analyzing market opportunities.

* Monday's market fell back and we registered short-term oversold readings, with about 26% of SPX stocks closing above their 3-day moving averages. What we're looking for in bull phases of cycles is short-term oversold readings at successively higher price levels. We've seen a bounce in overnight trading, consistent with that picture.

* That being said, on an intermediate-term basis, my cycle measures are quite extended to the upside, as illustrated below. In strong market cycles, we work out this overbought condition with minimum price damage, as occurred in October, 2015 following the September bottom. I'm quite open to that possibility in the current cycle, given recent price action. A break of today's overnight lows would lead me to question that scenario.

* Yet another indication of buying strength has been a recent peak in the ten-day moving average of the cumulative NYSE TICK. Note how it's not uncommon for peaks in the TICK measure to precede cycle price highs, as the thrust of buying power shows short-term momentum.

Monday, February 29th

* The previous post provided a chart for a useful short-term overbought/oversold measure. We're coming off overbought levels with weakness on Friday and in overnight trade. Note below that my intermediate-term measure of strength has also been stretched to the upside. In a strong market, those overbought conditions are worked off with modest price damage (i.e., they correct as much in time as in price); in a weak market, bounces from selloffs are modest and facilitate price damage. It is how the current cycle unfolds that lays the groundwork for the coming one.

* Breadth has been strong lately. Even after Friday's drop, we have over 70% of SPX stocks closing above their 3 and 5-day moving averages and over 80% above their 10 and 20-day averages. (Data from Index Indicators). At the February lows, we saw meaningful breadth divergence, with fewer shares making new lows than in January. Since that time, we've had a meaningful breadth thrust to the upside. That has become stretched and we're seeing corrective activity at present, but my base case is that the current cycle will bottom at a higher low relative to the February bottom and ultimately lead to further price gains.

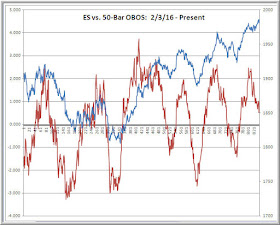

* My latest work has been refining intraday cycle measures to aid shorter-term trading but also to aid entry and exit execution for longer-term positions. These cycle measures are denominated in event bars, not time-based bars. Below is a 50-bar rate of change measure that I have found useful.

I encourage readers to check out the most recent Forbes post, detailing how a common information-processing bias has led to poor trading returns in the last year or two. When we make decisions as much for psychological reasons as logical ones, we become vulnerable to drawdowns.

Above is the five-day indicator described in the Forbes post. It is unique, in that it tracks strength across six technical indicators and then sums up across all NYSE stocks. As documented in the post, using this as an overbought/oversold measure has been helpful to entry and exit execution for longer-term positions and has also helped active traders avoid chasing recent returns.

Note how we've had a vigorous rally off the February lows and are now coming off overbought levels with price holding up relatively well thus far. This is not too different from what we saw after the September, 2015 and October, 2014 lows as, early in a market cycle, we don't see the pronounced mean reversion present at other points in the cycle.

I will update this measure periodically.

Further Reading: The Trading Bias Killing Recent Trading Returns

.

There are two sources of edge when trading financial markets: 1) looking at new information; and 2) looking at old information in new ways. The traditional sources of information are so mined that there is no edge in looking at old things in traditional ways. This is one reason that creativity is central to trading success.

Consider an experiment. Instead of taking a single technical indicator and applying it across all stocks to determine buy and sell candidates, let's identify the dominant cycle for each stock and project it into the next time period to provide unique buy and sell signals. Imagine, moreover, that we do that for all stocks listed on the New York Stock Exchange. Each stock has its own cyclical patterns that change over time; sometimes the dominant cycles will be shorter-term, other times longer-term. We're not taking one "system" and applying it to all stocks. Rather, we're identifying significant cyclical patterns for each stock and then aggregating the buy and sell signals to infer general market direction.

(For an example of such an approach, please see the work of John Ehlers).

Going back to late 2013, what we find is that when we have a high number of buy signals across stocks (top octile of the distribution), the next ten days in SPY average a gain of +.81%. When we have a high number of sell signals across the stock universe, the next ten days in SPY average a loss of -.40%.

Fascinatingly, the number of buy signals is only modestly correlated with the number of sell signals (r = -.17).

When we have a high number of sell signals across stocks, the next ten days in SPY average a loss of -.26%. When we have a low number of sell signals, the next tend days in SPY average a gain of +.78%.

In other words, we have two potential sources of edge in the market. The first is when we see broad strengths; the second is when we see a broad absence of weakness. Think about why that might be the case...

Take your traditional charts and technical tools and throw them away. Look at new information or creatively think through new ways to view traditional information. Your edge lies in the rigorous testing and implementation of uniqueness.

Further Reading: Cultivating Emotional Creativity

.

Friday, February 26th

* I found yesterday to be an important day in stocks. In early trade, we were unable to break the recent highs and my short position went into the money rather quickly. Then we saw meaningful buying come into the market, with subsequent selling unable to take the market to new lows on the day. I covered for a small profit and said to myself at that point, "sellers can't take this market lower." It was one of those cases where a "failed" trade provided meaningful information. We broke to new highs on the day and rather quickly took out the recent highs. That strength has continued in overnight trade and so far looks to be a meaningful upside break out. Of course, we need to hold yesterday's lows to validate that perspective.

* Here is a chart of short-term breadth among SPX shares. Note that we're staying overbought and making higher highs during that time. That's what bull phases of cycles do: they follow strength with strength. We had 237 stocks across all exchanges register fresh three-month highs against 114 lows. That's a breadth expansion.

* As the chart shows, of course, we *are* stretched in breadth. Over 80% of SPX stocks are trading above their 3, 5, 10, and 20-day moving averages. I would not be surprised to see some corrective activity in the near future, and I would not be surprised to see that activity base in the 1930s/1940s area for ES that had been prior resistance. Failure to hold that area would give me greater pause regarding the vigor of the rise from recent bear lows.

Thursday, February 25th

* After early weakness yesterday, we launched a significant rally, with strong buying readings from the NYSE TICK measure. Now the issue becomes how we trade around the recent highs and whether that buying interest can be sustained. This is particularly relevant, as many of my cycle measures are maturing:

* As you can see from the chart above, my bigger picture concern for this market is that we're seeing cycle peaks at progressively lower price highs, which is precisely what you'd expect in a bear market. That view suggests that, for longer-term traders, selling cycle highs that cannot make fresh price highs would be a promising strategy.

* A concerning aspect of this bigger picture is that financial shares are now the laggards in this market, year to date--not the commodity stocks. Here's a picture of sector performance from Finviz.com. When banking stocks are unusually weak, one has to be concerned about vulnerabilities within the broader financial systems. In this case the concerns are global, including China and Europe, not just U.S. financial institutions holding risky high yield/energy debt.

Wednesday, February 24th

* Yesterday saw a significant pullback in stocks--a trend day to the downside--with weakness continuing in overnight trade. The fall in oil prices, with hopes of production cuts dimming, continues to weigh on stocks as part of a general deflationary theme, with notably weak equity performance coming out of Europe. I continue to track these macro themes closely.

* Many of my cycle measures are maturing. Should forward market strength prove unable to decisively break above the 1940s area resistance for ES, I would look for a fresh leg down in stocks. The current market action, with the larger than normal drop yesterday and early today, reminds me of the cycle that occurred early in 2008, when a January low led to a choppy, but ultimately weak, cycle higher prior to the significant drops later in that year.

* Here's how we stand on one of my favorite measures, an intermediate-term gauge of new highs versus lows specific to the SPX stocks. Despite yesterday's weakness, we're closer to overbought status than oversold.

Tuesday, February 23rd

* We saw a solid rally on Monday, supportive of the breadth and money flow pictures noted in yesterday's post. I also note that yesterday saw the first close below 20 in VIX in a while. We're also seeing moderating volume in stocks. This should lead to more moderate volatility/daily ranges for the major market averages, which has implications for the placement of stops, targets, etc.

* Breadth continues to expand with the market rally. I generally become most skeptical of market rallies when a meaningful proportion of shares stop participating in the strength. Those are often the sectors that lead the subsequent downside. A good example from the most recent cycle was energy shares: they weakened far earlier than the broad market. Right now, we're seeing solid, expanding breadth, which is typical of a relatively young phase of an upward market cycle. That doesn't mean we can't have corrections, but those are contained in earlier cycle phases and are meant to be bought. Yesterday we had 934 stocks across all exchanges register fresh monthly highs against 109 new lows. The last time we had so many stocks making monthly highs was early November, 2015.

* I do note that, short-term, we're pretty stretched on those breadth measures. Below is a useful overbought/oversold measure, which is a five-day moving average of 5, 20, and100-day new highs versus new lows for all SPX shares. (Raw data from Index Indicators). It's not unusual for this to top out ahead of price during strong market cycles, but it's also not unusual to see some corrective activity prior to any upside continuation. As cycles mature, I'm much keener on buying pullbacks than counting on upside momentum following price highs. In a strong cycle, any such pullbacks are relatively contained and occur at successively higher price lows. Despite the recent strength, I am very open to the possibility that the current cycle will not be a strong one and will terminate below the level of the prior cycle as part of a longer-term market correction.

Monday, February 22nd

* Can we systematically make ourselves more successful in our work, our relationships, and in markets? Here are four key strategies for building on success, drawing from several excellent recent books.

* As I write, we're testing highs from the recent bounce; that fits with the breadth and money flow picture noted yesterday.

* I continue to find it useful to track the number of NYSE issues that give buy versus sell signals across a variety of market indicators. Here's a composite measure of indicators with relatively low correlations that adjusts the indicators for differences in volatility, so that each contributes more or less equally. We've moved above the zero line, but are not yet at levels normally associated with an overbought market.

Confirmation bias is the tendency to seek information that fits our preexisting views. The opposite of confirmation bias is open mindedness and the commitment to seek information that counters one's perspectives.

At market highs and lows, there is no lack of information to confirm bullish and bearish biases. At the highs, the economy looks strong, profits are solid, and sentiment is favorable. At the lows, fears abound; talk of recession and crisis dominates.

It's when actual market behavior deviates from these biases that we find opportunity.

Above is a chart of money flow for the SPY ETF, which is a function of the daily closing price and the number of SPY shares outstanding. When traders are bullish, their demand creates new ETF shares; when bearish, we see a contraction in shares outstanding as shares are redeemed.

Note how money flow peaked in late 2014 and moved steadily lower during 2015 before the market declines late that year and early this year. Bearish money flows, along with breadth declines, were among the factors leading me to fade strength during this period.

Now, however, we're seeing the opposite phenomenon. With the 2016 market declines, SPY money flow is actually holding above its August, 2015 levels. Moreover, at the February lows for SPY, we've seen fewer stocks register new lows relative to January. Specifically, we had 1226 new three-month lows across all exchanges on February 11th, compared with 2663 lows on January 20th. The February lows saw 19.36% of SPX shares trading above their 200-day moving averages, compared with 17.76% at the January lows. Among SPX shares, we had 101 more 100-day new lows than new highs at the February lows, compared with 151 more lows than highs in January.

Bearishness has abounded, with concerns over high yield credit, oil prices, European banks, weak China and EM, and questions over the effectiveness of the monetary policies of central banks. Despite these factors, it is difficult to find evidence of recent weakening in the U.S. stock market. That leaves me open minded to the possibility that we've put in an intermediate-term low in stocks, even as I also share concerns over the global macro picture.

Further Reading: Measuring Sentiment With Options

.

Mistakes are not a problem in trading.

The problem is repeated mistakes.

We repeat mistakes when we don't learn.

We don't learn if we don't review and reflect.

We look for the next trade, but fail to thoroughly evaluate the last one.

We don't want to miss the next move, so we miss learning about the last one.

And we repeat mistakes.

For better or worse, we create our trading karma.

Further Reading: Learning From Our Genius

.

Friday, February 19th

* We finally got some pullback in stocks following the breadth thrust off the lows noted in yesterday's post. It was not a broad pullback, however, as we actually saw marginally more stocks up on the day than down among NYSE shares. Among SPX stocks, we still had over 90% trading above their 5-day moving averages. I am watching closely what the bears can bring to the table here, with an eye toward seeing how we trade near yesterday's lows.

* Stocks making fresh one-month highs across all U.S. exchanges have handily outnumbered stocks making one-month lows for the second consecutive day. At Thursday's close we had 622 new highs against 145 new lows.

* We've bounced on my cycle measures, but are not yet at levels normally associated with intermediate-term market peaks.

Thursday, February 18th

* Yesterday's post noted that breadth thrusts following oversold conditions tend to lead to upside momentum in the near term. That is exactly what we saw on Wednesday, as we followed strength with yet another trend day to the upside. As I've indicated in the past, recognizing the early signs of an upside trend day is extremely useful for short-term traders.

* Meanwhile, the breadth thrust off the recent lows has continued in impressive fashion, once again highlighting that we've put in an important low and have embarked on a fresh cycle to the upside. While it's not unusual to get some pull back after very extended breadth readings (more than 90% of stocks above their short-term moving averages), those dips are generally meant to be bought. The chart below illustrates the recent breadth thrust.

Wednesday, February 17th

* After some morning weakness, stocks moved higher in the afternoon and have caught a fresh leg higher in overnight trading, consistent with yesterday's note expecting further upside follow-through after we made recent lows with significant breadth divergences. We closed Tuesday with very strong short-term breadth, as over 90% of SPX shares closed above their 3-day moving averages and over 85% above their 5-day averages. (Data from Index Indicators). Such upside thrust after weakness is typically followed by further strength, leaving a buying of dips the continued operative strategy.

* Here is my short-term measure of SPX shares making fresh 5, 20, and 100-day highs versus lows. It's been a useful overbought/oversold measure. Note how, despite the recent thrust higher, we are not near overbought territory that has been associated with intermediate-term market highs.

* The intraday trend system is on a BUY signal from 4 AM EST and would hit a sell signal at 1888 on the ES March contract. The purpose of the system is to identify intraday swings using event bars; signal levels change with each new bar and adjust dynamically for market volatility.

Tuesday, February 16th

* In a new article, I expand on the idea of time mapping and offer a heatmap-inspired example. This is a technique that is particularly useful in creating the motivation and momentum to make changes in any area of life, personal or professional. There are many techniques out there in the self-help literature to help people change; not so many methods to help people find the drive to sustain change.

* We've seen some consolidation in overnight trading after a sizable rally. Note that Friday closed with only 35% of SPX stocks trading above their 10-day moving averages. Even if the current rally ends up being a bounce in a broader bear market, I expect some upside follow through as we work off the oversold condition from a very weak start to the year.

* I continue to find overbought/oversold measures utilizing event bars to be useful in finding good trade location and identifying short-term market cycles. Below is a simple rate-of-change measure using event bars, where each bar represents 500 price changes in the ES futures. Other event charts that I maintain draw the bars on the basis of number of trades and on the basis of volume transacted. My most recent trend-following system makes use of event bars and has done quite well identifying intraday swings. As of this writing, that system enters SELL mode below 1881 in the March contract. The buy and sell parameters change with each new bar and adjust in real time for market volatility.

Monday, February 15th

* We tested the January lows this past week, but--as noted in previous postings--breadth divergences were striking. Specifically, we registered 1226 fresh three-month lows across all exchanges on Thursday and 1353 new lows on Monday. At the January bottom, we saw 2663 stocks make fresh three-month lows. Since that test, we've moved smartly higher on Friday and then again in overnight trading. My short-term trend model is solidly in buy mode and has been since Friday morning.

* An ongoing research project has been assessing market cycles by tracking the performance of all NYSE stocks across a variety of technical indicators. (Raw data from stockcharts.com). The measure below takes a volatility-weighted composite of buy versus sell signals for two technical systems: Bollinger Bands and Parabolic SAR. Note that we closed Friday at levels close to those seen at intermediate-term bottoms and have quite a way to go before we see overbought levels.

* Here is yet another cycle based measure derived from breadth data (Raw data from indexindicators.com). Note that it is in oversold territory, but not at levels seen at most intermediate-term lows and well off overbought levels. If indeed we have seen a successful retest of January lows, I would expect market firmness to take these cycle measures higher.

* I would identify the greatest improvement to my trading as coming from focusing away from trends and directional movement and instead thinking of cycles and the transitions from trending to mean-reverting behavior and back again. A cycle includes phases of upward and downward trending, as well as range behavior near highs and lows. Identifying these transitions--and not getting caught up in any one phase of market behavior--is very helpful to short-term trading.

As the quote from Peter Drucker suggests, efficiency is of limited value if we're not effective. We not only need to do things right, but ensure that we're doing the right things.

What goes into successful trading processes? Here are three hallmarks of effectiveness that I've observed across a variety of professional traders:

1) Original Research - I recently spoke with a trader about the difference between trading ideas that you develop for yourself vs. ideas that you borrow from what your read or hear from others. The successful traders I know do their own work. Yes, they discuss ideas with people and, yes, they read research, but where they add value is in how they synthesize that information. Without digging into ideas on your own, you never truly achieve a sense of discovery and conviction in those ideas. As a result, it's easy to give up on the trades as soon as they encounter adverse price movement. The best trading ideas are distinguished by their breadth (combining information across time frames and/or markets); depth (level of detail and understanding); and originality (looking at new things or viewing old things in new ways). Successful generation of ideas goes beyond consensus thinking.

2) Planful Expression and Management of Trades - The successful traders I know put considerable time into structuring their trades (finding very good risk/reward) and managing their positions (scaling in or out of trades, managing risk/reward in real time). One trader recently wanted to benefit from an anticipated decline in stocks, but was concerned about sharp short-covering rallies. He bought a long dated put spread and limited his dollar exposure to the trade. That allowed him to ride out market choppiness and take a nice profit on the position when volatility expanded. The thoughtful use of options enabled him to participate in a move that others missed because of getting stopped out due to market noise. Yet another trader I know achieved a similar end by holding modestly sized core positions, trading with wider stops, and tactically taking profits when markets became stretched in a favorable direction. Money management is central to the effectiveness of trading processes.

3) Detailed Reviews - The best trading processes include an element of quality control. By periodically reviewing performance and highlighting areas for improvement, traders ensure that they are learning and developing even as they may be drawing down. As I've emphasized elsewhere, those detailed reviews also include episodes of very positive performance. Traders who reverse engineer and map out their strengths are in a good position to turn best practices into process-driven habits. Trading reviews provide the foundation of trading goals, and trading goals provide the template for future trading plans and actions. Without reviews, goal setting, and further reviews, trading experience will not turn into trading expertise. We learn, not from experience, but from what we do with our experience.

How effective is your trading? What are you doing that is special and unique in each of these three areas? If we don't do great things each day, our experience is unlikely to add up to anything great.

Further Reading: Productivity and Success

.

Suppose you were to map how you use each hour of each day. And suppose you were to rate each mapped hour on the basis of the quality of the time you spent. So if you spent the time in rest, you would rate the quality of the rest. If you spent the time socializing, you'd rate the quality of your social experience. If you spent the time researching markets, you'd rate the quality of your research effort.

What you'd learn from such a time mapping is at least two things:

1) Are you truly acting on your priorities? Are you utilizing your time the way you truly want to?

2) Are you using your time effectively? Are you doing well the things you're trying to do?

The right kind of time map would be a tool for staying mindful, for ensuring that we don't merely live life on autopilot.

The right kind of time map would also be a tool for becoming better at living our values--making sure that we are living the life that defines who we wish to be.

Without a time map, we live too much of life on autopilot. We spend time on low priorities and we spend low quality time on our priorities.

Whatever kind of life we choose, we should live that life consciously: with purpose and direction. We would not take a cross-country trip without consulting a map; why approach our lives that way?

Further Reading: The Purpose of a Purposeful Life

Addendum: Here is a simple version of a time map. The activities are color coded and organized in time from left to right. The time blocks represent the relative amount of time spent in each activity. The shading of each block represents whether the activity was performed very well (darker shading) or not very well (lighter shading). Each map represents one day. Comparing the maps from day to day illustrates how we're spending our time and how well we're spending it.

.

Friday, February 12th

* We've continued to see a risk off trade, with higher fixed income prices, higher gold, and stocks testing their January lows. Interestingly, breadth has continued to hold up relatively well. For example, we saw 1226 fresh three-month lows across all exchanges yesterday versus 1353 on Monday and 2663 at the January bottom. That being said, we continue to see weakness among financial shares and that is concerning. There is much more media chatter regarding the possibilities of recession. I am watching those breadth figures closely.

* We're short-term oversold, with fewer than 20% of SPX shares trading above their 3, 5, and 10-day moving averages. With overnight and retail sales strength, we're seeing some firmness in stocks ahead of the open. Nonetheless, one of my key cycle gauges is not yet in territory that has characterized recent intermediate-term bottoms.

Wednesday, February 10th

* It is actually relatively easy to change our behavior; relatively difficult to sustain those changes. Here's what we can do about that.

* We've seen several efforts for U.S. stocks to make new lows, only to bounce higher. That was notable yesterday, as stocks held their lows even in the face of the oil selloff. We're seeing fresh buying during London hours before today's U.S. open and I'm looking to buy dips that hold above the London lows.

* Breadth numbers during the recent weakness have also held up relatively well. On January 20th, we had 2663 stocks across all exchanges make fresh three-month lows. On Monday, that number was 1353 and yesterday it was 1086. Interestingly, while banking shares have been relatively weak, the commodity-related energy and raw materials shares (XLE, XLB) have held up relatively well.

* In some ways, this market decline reminds me of the May, 2010 episode that followed the flash crash. Stocks didn't make a price bottom until August, but there were plenty of bounces and breadth divergences along the way. Selling weakness and buying strength did not work in that environment.

* I've developed a short-term trading system using a trend-following method with event-based bars. Still early days, but it's looking promising. The system went long ES overnight at 1851.75; it exits at a closing bar below1844.50. The buy and sell points move with the market and naturally adjust to the market's volatility. I will be testing out and updating via the blog.

What does it mean to have the wind to your back as a trader?

Many would respond in terms of trend behavior. You have the wind at your back, many believe, if you are trading in the direction of the trend.

A different way of viewing wind at your back is aligning yourself with the behavior of the largest market participants. If you can see large institutions lining up on the buy or sell side, you have an opportunity to be nimble and participate. Rarely are large directional participants trading for a matter of ticks. Rather, they are trading on the basis of macroeconomic themes that provide the fuel for market trends.

So how can you identify macro themes in the making and place the wind of portfolio managers at your back? Three ways stand out:

1) Watch intermarket correlations - When money managers are placing bets on macro themes, those themes find multiple expressions across currency, equity, and rates markets. They also find expressions across global markets. When you see correlations rise among assets, there's a good likelihood that the correlations are part of important macro themes. A good example during 2016 to date has been the high correlations among oil, stocks, and emerging market currencies.

2) Watch volume and volatility - If institutional participants are betting on a theme, you can expect volume and volatility to expand in the direction of that theme. A market with low volume is a market dominated by market makers. They do not make their living trading medium-term market themes. When large, directional participants enter a market, they contribute volume and that contributes volatility--especially when market makers stand aside to avoid getting run over by large directional flows. In the stock market, you can see where enhanced volume leads to high levels of upticking or downticking across a large group of stocks (NYSE TICK). That's a great tell for enhanced directional interest.

3) Watch relative performance among stock sectors - Many times we see macro themes reflected in the relative performance of one stock market sector versus others. For example, energy stocks for quite a while underperformed the overall market and underperformed consumer shares as part of the weak oil/deflation theme. Recently, we've seen concerns over global debt weigh on the relative performance of banking shares both within the U.S. and globally. When sectors persist in underperforming or outperforming, the chances are good that there's a macro story involved.

It's a common mistake to become tunnel visioned during times of market stress and only follow the position(s) you are trading. That blinds us to the waxing and waning of macro themes and the influence of large market participants. You may not trade the markets thematically yourself, but it helps to have those themes at your back--and certainly not in your face.

Further Reading: The Most Common Mistake Losing Traders Make

.

I recently spoke with the traders at SMB and shared a few best practices that had benefited my trading over the past several months. The idea is not that any traders should mimic my trading; rather, traders need to learn from their successes, identify what they are doing well, and then become more consistent in implementing those strengths.

Here are a few of my trading performance observations that might spark some thought for your trading:

1) My profitability has improved since I've focused on consistency rather than profitability. I've honed in on what are good trades for me and where my profits have come from. I just want to be consistent in trading those good trades. If I can do that, the profitability will come. And if I want greater profitability, I should size up the good trades, not take other, more marginal trades.

2) A corollary of the above is that my best trading has been highly selective trading. There are days and series of days when I don't place a trade. I'm fine with that. My aim is not to trade; my aim is to make money.

3) The amount of time I spend staring at screens is not correlated with my profitability. If you're a high frequency trader, you need to track each tick in the market. If you're not a high frequency trader and you're staring at each tick in the market, you're either lacking confidence in your trade or you're sized too large and taking too much risk. When I'm in a good trade, I can walk away for a while.

4) I've found my own way of making sense of markets. I think in terms of cycles, not trends. (See above). When I assess shorter-term cycles, it's over event time, not chronological time. When I look at volatility, it's by comparing the volatility priced into options versus the volatility recently realized in price action. All of these are ways of thinking about markets that I've studied and that make sense to me. I don't know how to have staying power in a trade if it's not an idea that makes deep sense.

5) I've studied the trajectory of my profitable and unprofitable trades. Many of the trades I enter will anticipate a market move following a period of compressed volatility. I generally anticipate the ramping up of volatility pretty well. If it ramps in the wrong direction, my trade goes wrong relatively quickly. By entering the trade with a small core position, I ensure that a losing trade won't be a large trade. If the volatility moves in my expected direction, I can use bounces against the move to add to the position. I don't add to losing trades and I'm quick to take profits opportunistically on added pieces of trades. Sound money management has been the best form of psychological management.

6) One of my best predictors of making money is having fun with markets. I have fun when I develop new tools, generate new ideas, and see them work in practice. If I focus too much on making money or not losing money, all the fun goes away from trading. That's when I'm likely to make bad decisions. If I'm having fun with markets, I don't need to trade. If I need to trade, I don't have fun with markets.

7) I'm best when I specialize. I trade one thing and one thing only, the ES futures. I study high frequency data on stocks (upticks/downticks, patterns of very short-term price and volume behavior); I study unusual measures of market breadth; I study cycles of various market sectors; etc. I don't trade different individual stocks and I don't trade other asset classes. My goal is to be a product specialist, not a trading generalist. That has helped greatly in my pattern recognition. If I were to look at different stocks and markets each day, I would not build up the database of patterns I would need to recognize opportunities.

The big idea here is that getting to that next level of trading performance requires self-awareness. You need to know what you're good at, what speaks to you, and where your successes come from. You get to the next level, not by changing who you are, but by distilling the essence of who you are and becoming ever better in leveraging that.

Further Reading: Our Struggles Develop Our Strengths

.

Friday, February 5th

* Despite a morning selloff after early strength, stocks finished the day on the firm side. 432 stocks across all exchanges touched monthly highs versus 293 monthly lows. Over 50% of SPX shares are trading above their 3, 5, 10, and 20-day moving averages. I am watching closely to see if breadth can expand in today's trade. The response to the non-farm payrolls number will have a lot to do with that.

* Interestingly, my cycle measures are near levels that have corresponded to market tops. Should we be unable to surmount the highs reached on February 1st, that would invite the hypothesis that we've put in an intermediate-term top and are likely to retest recent lows.

* Working off the oversold cycle readings with a relatively modest bounce from the lows is once again an indication that the 2016 market is different from those experienced in 2014 and 2015. The weaker US dollar has added an interesting element to stock prices. Note the recent strength of raw materials share (XLB). The bounce in housing shares (XHB) has not been impressive.

Wednesday, February 3rd

* Tuesday's trade in ES nicely illustrated the dynamics of a downside trend day, including an opening price near the high price for the day session; negative NYSE TICK dominating positive readings, with many readings < -800; a very negative advance/decline line; and a great majority of NYSE stocks trading below their VWAPs for the day. Trend days often feature above average volume, as directional, macro participants express an intermarket theme. In yesterday's case, we saw the resumption of the risk-off trade involving oil, stocks, high yield credit, and emerging markets. I am watching those intermarket relationships carefully from day to day.

* A useful short-term overbought/oversold measure is a five-day moving average of upticking vs. downticking among NYSE stocks. Note how we reached a short-term peak recently.

Tuesday, February 2nd

* After early weakness, we continued to move higher on Monday, hitting a new high for the recent rally off the lows. Across all exchanges, we had 502 shares register fresh monthly new highs against 251 new lows. That is a modest expansion from Friday's levels. Oil continues to come well off its recent highs and we've seen selling in stocks in premarket trading. Interestingly, stocks are lower in Japan following the BOJ action and we're down in Europe as well. At least so far, the rally off the lows still strikes me as part of a bottoming process, not a fresh bull market leg.

* Here's a look at one of my primary cycle measures. My base case that this cycle will top out at a lower price high and lead to a test of the recent market lows. Should we see waning breadth on the upside on future strength, that would add credence to this view. As of Monday's close, we were short-term overbought, with over 80% of SPX shares closing above their 3, 5, and 10-day moving averages. (Data from Index Indicators; it's a great site for breadth info).

* A look at sectors from the excellent FinViz site finds that yield-sensitive utility and consumer staples shares have led market performance year-to-date. Interestingly, financial shares are among the largest losers during 2016 thus far. Given concerns over debt--China and high yield--this is not a bullish configuration of sector strength. It's clearly defensive.

Monday, February 1st

* Here's a valuable self-coaching technique to help prevent impulsive decision making in the heat of trading.

* I was less than enamored with the bounce we had made off the lows when I wrote Friday's entry, but flows changed radically with the New York open, as we saw consistent strong buying in the wake of the BOJ's negative rate decision. After a strong opening rise, we saw significant selling pressure late in the morning, which completely failed to take the market significantly lower. From there buyers remained in control, as we completed a trend day. One of the important takeaways from the session is the importance of viewing each major time period (Asia; Europe; US) as a distinct "day", with its own set of market participants. When we see discontinuity from one time period to another, that is important information and requires quick adjustment.

* Breadth expanded significantly with Friday's strong rise. Across all exchanges, we saw 436 fresh monthly highs against 296 lows. It was the first time since December 30th that monthly highs have outnumbered lows. Similarly, Friday saw over 80% of SPX stocks close above their 3 and 5-day moving averages and almost 80% above their 10-day averages. This was not only a strong rally, but a broad one. If, indeed, the BOJ decision was a game-changer for stocks, we should not revisit the post BOJ lows from Friday. A return to that 1880 area would be an important reversal from a longer-term perspective, and one that would be consistent with the topping view outlined last week.

* We've pulled back in overnight trade, with a sharp decline in oil. I am watching carefully to see if that correlation between stocks and oil reasserts itself. I'm also watching closely to see if we can stay above that 1880 level in the ES futures outlined above.