One of the best ways of killing a trending market is to develop a tradable index for it. And if you really want to drive a stake in its heart, you develop multiple tradable indices.

Why?

The indices provide arbitrage opportunities, which mean that an increasing proportion of volume is devoted to keeping stocks in line with the index, index 1 in line with index 2, etc.

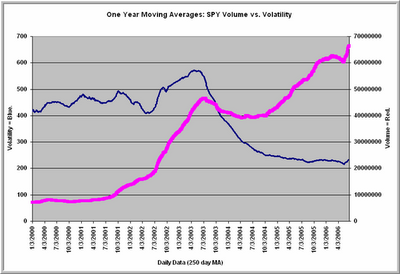

That's how you get the chart above, which tracks average volume and volatility in SPY from 2000 to the present. Note that volume in SPY has steadily risen to all time highs. Volatility, however, has steadily decreased from 2003 to the present, the recent uptick notwithstanding.

With the recent hyperexpansion of ETFs, this has important implications. Increased liquidity over time will bring a range of markets to the average stock trader that, to this point, have not been available. With that volume, however, may come trading patterns that make the market harder to trade with traditional momentum/trend tools.

In a recent study, I showed how the propensity to trend has been coming out of the S&P market on a long-term basis. If I'm right, this might be the future for those stock sectors and markets that attract significant attention from index players. Automated index arbitrage brings significant volume to markets, but it is not necessarily the volume that contributes to directional market trade.